As an entrepreneur, you need to focus your sales efforts on your most valuable customers, the people that can take your business to the next level. But are you aware of the value that every customer has for your company?

Do you know the value of each customer that you reach with your marketing efforts? Learning more about Customer Lifetime Value (CLV) will help you answer these questions.

All customers are not equal. As a business owner, you must know that some buyers provide more revenue with fewer costs than other customers. That’s crucial for the profit of your business, and to learn where to focus your sales and nurturing efforts is key if you want to maximize your profit.

For business owners, managers and marketers, the ability to calculate what customers are worth is attractive. That’s what makes CLV so popular in the business world – it brings both quantitative precision and a powerful viewpoint to customer acquisition and relationships.

What Is Customer Lifetime Value (CLV)?

Customer Lifetime Value is the total amount of money that you expect a given customer to spend on your business in his/her lifetime. It is a metric that measures the net profit or revenue that you earn from the entire relationship with the customer.

Understanding CLV is of huge importance when measuring your revenue metrics. It tells you how much revenue people will bring in over the estimated course of their relationship with your company.

Every single one of your clients has a distinct value and their own average CLV. While most of the business world talks about average customer value, if you have more than one target group, you’ll want to calculate the CLV for each of them.

By calculating it for each target customer, you’ll discover which of your target buyers have the biggest lifetime value for your business.

Related: Customer Retention Marketing Strategies for Software and Tech SMEs

Why Is Customer Lifetime Value Important?

It’s one of the most important metrics in business analytics. If you don’t know the value of your target customer, you can’t plan the desired actions needed by your company to obtain these customers.

Read: The Complete Guide to Finding Your Target Market

Customer lifetime value is important for the profitability of your business, and to discover if you’re doing a good job with your loyal customers. The most loyal customers are also your most profitable customers. As the loyalty increases, customers will constantly recommend you, and bring new customers with a referral.

Getting your CVL right directly affects the bottom line of your business. Optimizing for customer lifetime value means getting repeat orders from your existing clients. This way, you can keep paying less than the cost of acquisition each time, increasing profit margins and ROI.

Also, repeat business from existing customers is a great way to bring in steady cash flow. It means you don’t need as much money upfront for startup costs. This is because the more orders that come through your doors – the greater amount of time before any other expenses will be due out of pocket. As a result, you can project how long each payment should take since there’s no guesswork involved!

Is Calculating CLV hard?

In most cases, calculating a precise customer lifetime value is difficult due to the complex and dubious behavior of customers today. There are many formulas that you can use to determine the exact worth of customers. But again, that doesn’t mean that the calculation will be precise. How can you know in advance how much someone will spend on your products in the future?

The positive thing about calculating CLV is that you can understand the buying pattern of a certain type of customer, and this can help you predict future purchasing behaviors.

How to Measure CLV?

Before we take a look at the exact formula for calculating CLV, let’s have a look at three crucial pieces of information that you’ll need:

- Average Buying Value – This is the average amount that a given group of customers spends every time they buy. To calculate ABV, divide total sales by the exact number of purchases.

- Buying Frequency – The number of times that a given customer bought from you in a set period. A customer that buys often is more likely to come back for more. To calculate the buying frequency, divide the total number of purchases by the number of customers for the given timeframe.

- Customer Value – The amount that a customer spends in a given period. A customer that spends more is more likely to give you money in the future too. To calculate, multiply the average buying value by the buying frequency.

Calculating CLV

The easiest way to calculate customer lifetime value is with the following formula:

CLV = Average Purchase Value x Number of Customer Purchases Per Year X Average Length of Customer Relationship

For example, you own a shop that sells business attire. If a customer buys one blazer, it costs $300. If the same customer buys 3 blazers per year that would be $900. 3 blazers per year times 20 years would be $18000.

That is not a bad lifetime income to have from just one customer. Imagine having 50 regular and loyal customers (that’s $900000) for your shop. Now you can see why CLV is such an important metric.

How to Utilize CLV for Your Business

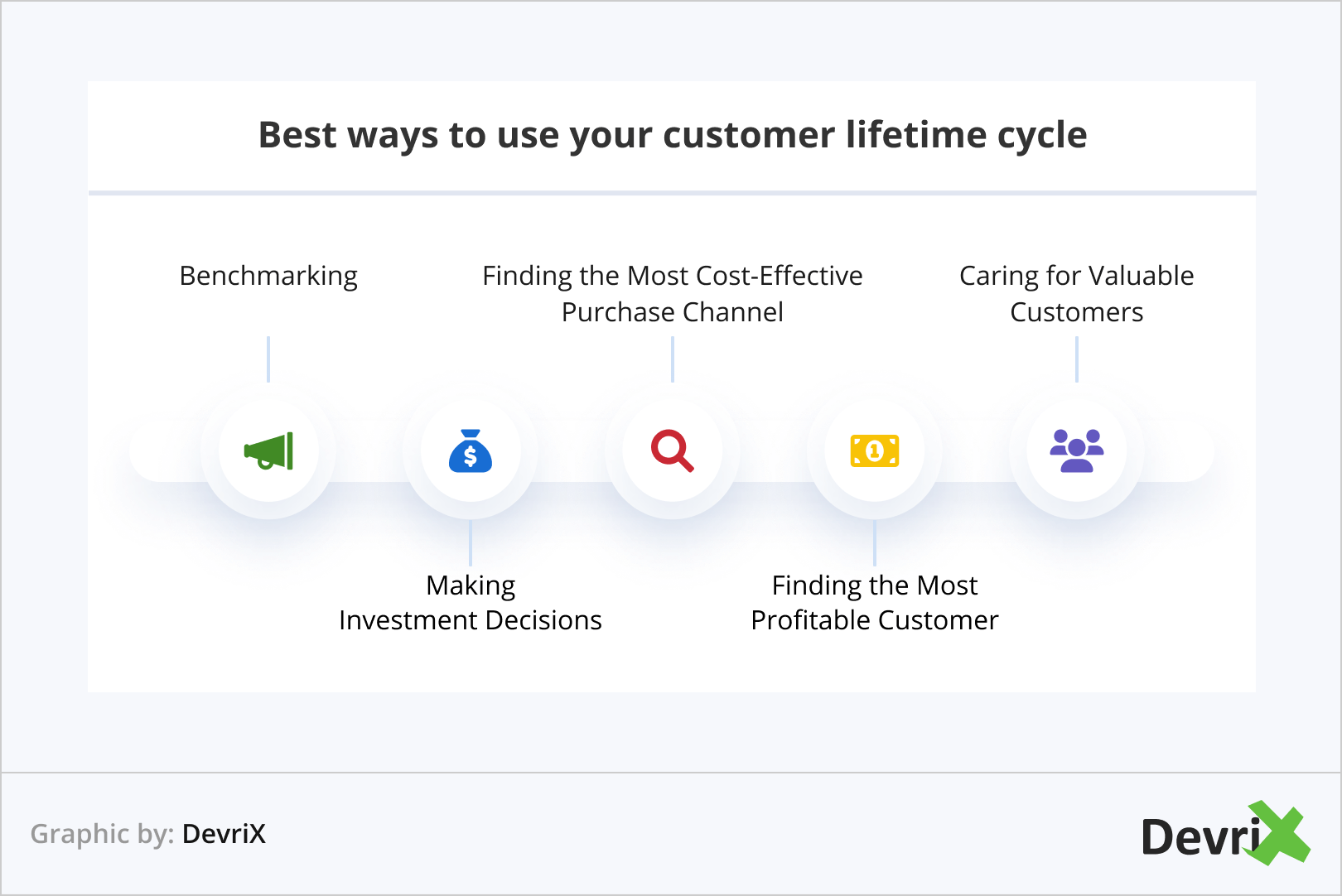

There’s no point in knowing the CLV of your best customers if you don’t use the information to further develop your company. Some of the best ways to use your customer lifetime value are:

- Benchmarking – Successful businesses know that CLV will determine their sustainability and future growth. This should always improve and grow in value. That’s why your CLV should be calculated more than once a year to determine your benchmark and see if you’re progressing or not.

- Making Investment Decisions – When you know the target customer lifetime value, you can examine where you can invest your time, money and attention to further improve your business.

- Finding the Most Cost-Effective Purchase Channel – CLV can be used to segment your customers. One of the best ways to segment them is by purchase channel. This will point out to the channel that is creating the most profitable buyers, and how much a customer from each channel is worth.

- Finding the Most Profitable Customer – You can do this by determining the CLV of various demographics such as gender, age, location, etc. When you know what your most profitable customer looks like, you can customize your offers and content to suit their needs.

- Caring for Valuable Customers – CLV is useful information especially when you deal with customer complaints. When you know the value a particular target group brings to your business it is a lot easier to rationalize the amount that you’ll spend to keep them as customers.

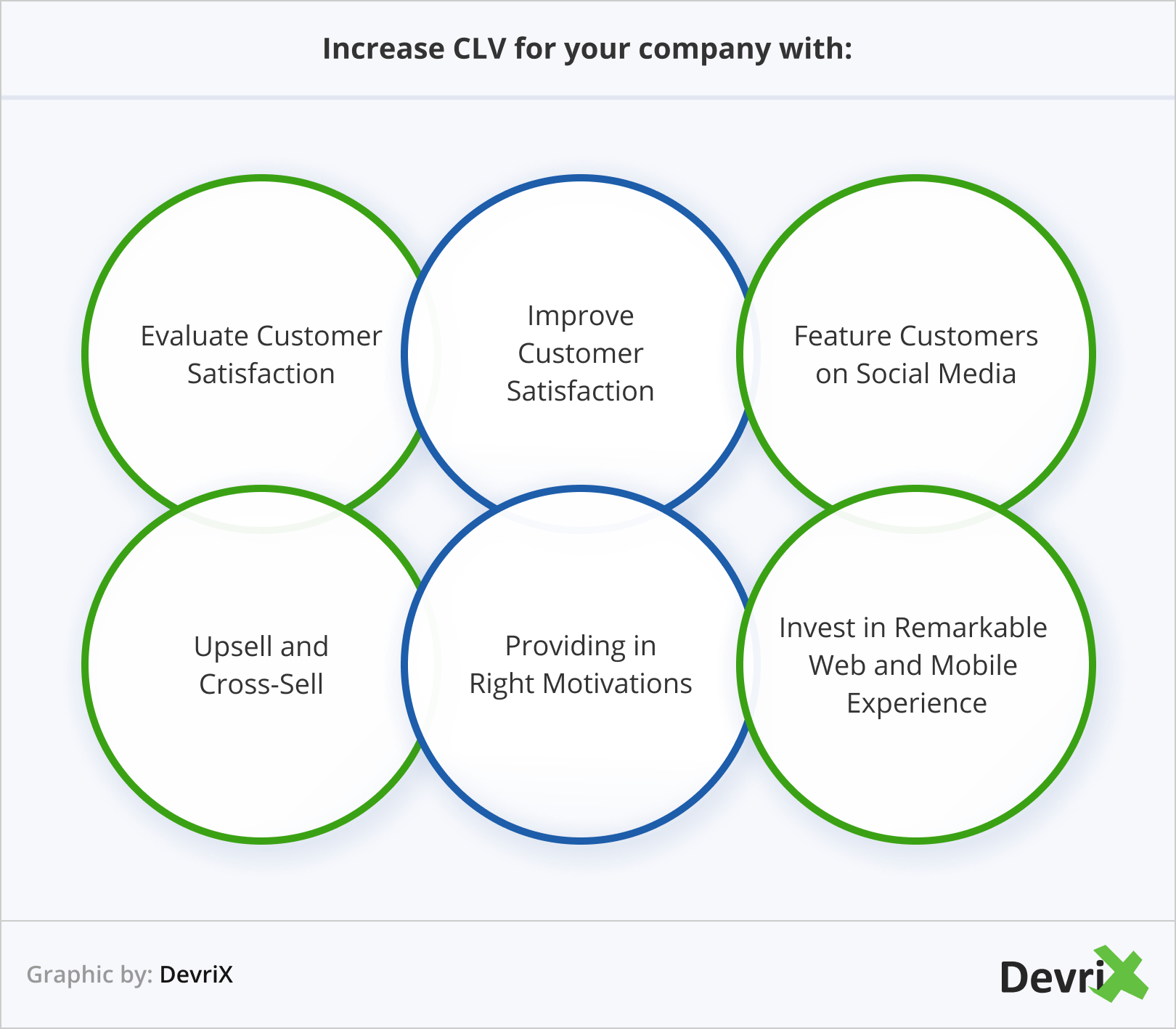

Regardless of how you measure it, it’s vital to do whatever you possibly can to improve the customer lifetime value. To increase CLV for your company, we suggest the following:

- Evaluate Customer Satisfaction – As a business owner, you must know how happy your current customers are. The increase of CLV is directly correlated with customer happiness. Measuring customer satisfaction will help you assess whether your company’s strategy has room for improvements.

- Improve Customer Satisfaction – When you evaluate the base points of how much your customers are satisfied, it’s time to improve that. Even small improvements can have an enormous impact on your buyers’ lives. Having an improved product helps, but also, an excellent customer service that meets buyers’ expectations makes people happy and adds extra value to your company.

- Feature Customers on Social Media – Put customers that said something great about you in the spotlight. Let people know that you really appreciate them. People will notice this and respond by making your company a priority when it comes to buying and in social media.

Related: [Infographic] 10 Actionable Tips to Make Social Media Work For Your Brand

- Upsell and Cross-sell – Want to extract as much value as possible from your customers? Try McDonalds’s tactics. Have you ever seen someone walk out of there with just a tiny hamburger? Probably not, because everyone buys a combo with a discount for the sandwich, soda, and chips. Upselling and cross-selling will give your CLV a big boost. You improve the product, and you increase the value of it.

- Providing the Right Motivations – You need to grab the customer’s attention and hold it as long as possible. Promoting loyalty programs and exclusive products will increase your CLV in the long run. Communicate with your most valuable customers and educate them on attainable awards and products. You can also use free samples to recommend product trials and effective cross-selling.

- Invest in Remarkable Web and Mobile Experience – There’s no greater satisfaction for your online customer than finding a product presentation on a beautiful website that functions excellently and provides him/her with the content that he/she needs to solve a problem. Besides attractive design, make sure that the website is mobile responsive, loads fast and follows the best SEO practices.

Related: Remarkable Websites: WordPress Maintenance Can Take You There

When you increase your customer’s lifetime value, you actually grow customer loyalty, profitability, and marketing allocations in one hit. Remember to focus on the customers who already like your brand and regularly buy from you.

Wrapping Up

CLV is important for your business growth and long-term success. It may not be easy to recognize your most valuable customers, but it’s worth it. Think about how you can integrate your customer data and processes to increase CLV. The best investment you can make when measuring customer lifetime value is to make sure you’re investing yourself in your customers’ lifetime value.

When you know the true CVL of your customers, you’ll be able to make better decisions when you sell and market your products. Don’t try to force things. Remember that it’s all about finding the right customers for your company.