Last year was marked by so many fundamental social and business changes. Digital advertising was no exception. Especially in adtech, 2020 not only confronted us with new challenges but also increased the effect of already existing problems. It is no news that the industry is suffering from a lot of inefficiencies due to the increasing number of advertising actors involved and all the difficulties in having to correct attribution models.

According to a PwC’s study more than 15% of the adtech supply chain is unattributable. This is the so-called unknown ‘delta’ of ad spending or ‘ad tax.’ It turns out that less than 51% of the advertiser’s budget in fact goes to the publishers. As theDrum put it:

Systemic inefficiencies to limited oversight, to a value-draining lack of context around ad placements, the news media is wrestling with providing crucial coverage against a significant revenue shortfall.

And last year, all of these adtech inefficiencies were exacerbated.

As noted in research done by the NewYorkTimes, the news media has been massively hit by the pandemic. This has forced publications, which rely solely on ads, to shut down and more than 37,000 people in the industry in the US alone were laid off. With diminished ad spending, many publishers were having a hard time staying afloat.

In addition to all those problems, we are yet to see one of the most fundamental technology advances in the adtech industry in many years – making third-party cookies obsolete. As elaborated in Google’s actions, especially, will mark “a massive change for the advertising industry and the publishers that often depend on their marketers’ ability to (for better or for worse) track users across the web,” as elaborated in TechCrunch.

Google has been encouraging the industry to take part in finding the right solutions. There are already a lot of proposals such as Trust tokens and First-party sets. Other ones are ‘Audience creation’ and Fledge (First “Locally-Executed Decision over Groups” Experiment), which is set to run this year. Here is Chrome’s list of all active trials where you test and send feedback.

One of Google’s proposals for interest-based advertising called FloC (Federated Learning of Cohorts), which Google shared recently has been moved ahead as something to stay. And in theory, there are optimistic outcomes – the First “Locally-Executed Decision over Groups” Experiment around 95 percent of all conversions could be attributed, which makes them comparable as effective as cookies.

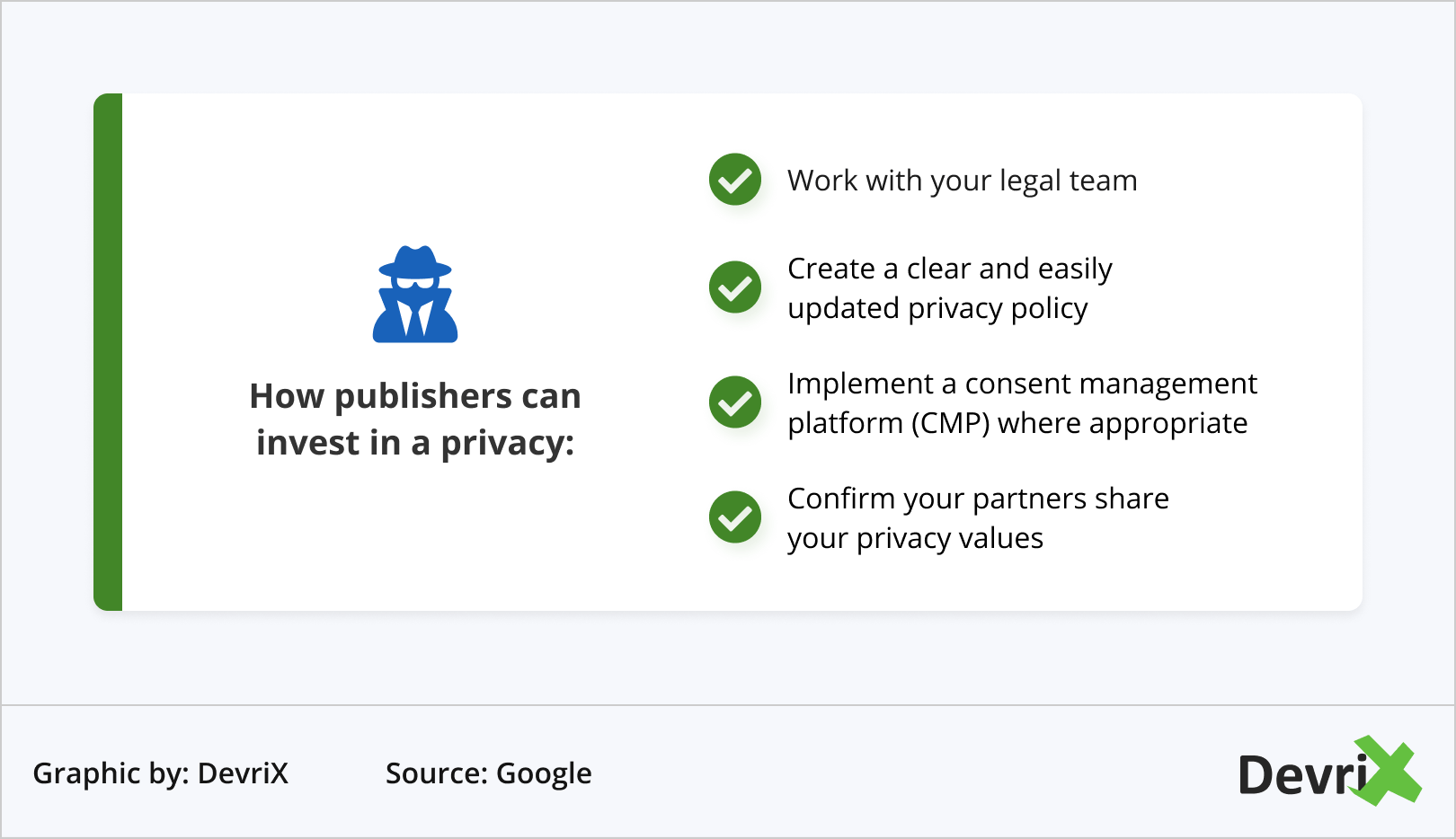

In the past two years, all publishers have been affected by the General Data-Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the US and they have had to make changes to the way they treat the personal data of their users.

Although publishers can look for innovative ways to collect first-party data, they are quite dependent on all browsers’ decisions. In response to the emerging privacy data laws, the industry had to rethink new approaches to targeting, which is essential for advertising. Thankfully, Safari and Firefox were ahead of the game.

Back in 2017, Apple introduced their solution for a cookie-depleted browser – Safari’s Intelligent Tracking Prevention (ITP). With the App Tracking Transparency (ATT) policy as part of the iOS 14 update, app publishers might experience an impact on their Google ad revenues on iOS.

According to recent news, Apple’s latest updates on ATT and IDFA (Identity for Advertisers) will be quite important. Due to Apple’s change, Facebook might actually take a hit of more than a 7% loss in revenue in Q2 (or roughly 5 billion), according to AdExchange. The loss could be smaller or bigger depending on how much better they will be able to do contextual targeting.

At the end of 2019, Mozilla Firefox also took the radical approach to simply block most of its third-party cookies by default. This setting also blocks crypto miners and fingerprinting scripts on both desktop and mobile. Mozilla’s Enhanced Tracking Protection (ETP) gives the user more control as well.

However, with the highest worldwide user share, all eyes are on Google. All participants in the digital advertising ecosystem will be affected by the way Chrome decides to fit in the new privacy-oriented environment. Google has announced that they plan to come up with working solutions over the next year, which makes 2021 very crucial for publishers, advertisers, and all ad vendors alike.

1. A New Reality for Publishers

Although the uncertainty around these fundamental changes might seem frightening, from the publisher’s perspective, they could turn out to be quite beneficial. Finding a better alternative to cookies, which have been part of the web since the distant 1994, has been a very hard and time-consuming task. Some even call it the white whale of adtech. To some extent, cookies have favored the advertisers, many of which in the past decade have collaborated with data-mining companies to obtain third-party cookies, to target a particular niche audience even better.

According to a recent study by the Wall Street Journal, the behavioral targeting was actually never in favor of publishers: “in one of the first empirical studies of the impacts of behaviorally targeted advertising on online publishers’ revenue, researchers at the University of Minnesota, University of California, Irvine, and Carnegie Mellon University suggest publishers only get about 4% more revenue for an ad impression that has a cookie enabled than for one that doesn’t”. The introduction of new ways to target audiences, such as User IDs, can lead to a much higher increase in ad revenue.

There are also opposing theories, that removing cookies entirely will lead to ad revenue drops for publishers due to diminished ad budgets from advertisers. For example, according to Google:

Recent studies have shown that when advertising is made less relevant by removing cookies, funding for publishers falls by 52% on average.

Due to decreased ROIs of ad campaigns in the absence of targeted remarketing, so will the willingness to pay.

Furthermore, we also have to be careful about introducing new solutions which may turn out to be less secure. Last year, Google found a flaw in Apple’s tracking system, pointing out that it might compromise the privacy of its users, which resulted in an ITP update.

Another example is fingerprinting, which in fact could be used for tracking. In Chrome’s blog, engineer Schur pointed out that:

By undermining the business model of many ad-supported websites, blunt approaches to cookies encourage the use of opaque techniques such as fingerprinting (an invasive workaround to replace cookies), which can actually reduce user privacy and control.

Google insists that they do not want to do this alone but in collaboration with publishers, advertisers, and all parties involved in the advertising ecosystem. Unlike Safari and Firefox, Google, being a part of almost all programmatic branches, has more skin in the game, because they couldn’t stop supporting third-party cookies without making sure that all parties involved are able to survive the changes.

What is an identity graph?

Another solution to the problem could be an identity graph. An identity graph is a collection of information on users on different devices which includes their interactions with brick-and-mortar stores.

The use of identity graphs could be helpful to differentiate a particular user who has made different actions in different environments. There is online and offline data collection, then the universal id is created, followed by matching of all the profiles.

The graph represents the so-called lifetime value of the users, which is also a new feature of the GA4 ( Google Analytics 4). If you as a publisher consider incorporating an ID graph, be sure that your vendor provides a persistent ID solution. Here are a few providers: LiveRamp, Zeotap, Lotame, and Infosum.

2. Google’s Solutions

In 2019, Google introduced a solution to address the growing privacy concerns, the Privacy Sandbox. However, there are still some contradictory reviews about it. As the CEO of publisher trade group Digital Content Text said ”Publishers don’t trust Google on this” and the publishing industry as a whole is quite skeptical of those proposals. At the end of 2020, Google started its migration to a more privacy-oriented browser with conversion measurement practices and personalization.

Last September, Google also launched the Google Consent Mode which introduced two new tag settings for advertisers, to some extent in response to the resistance from marketers and agencies, who were worried about collecting non-identifying data but also display contextual ads. Recently, they have also made some improvements on the way ads are being served by adding more information to the tool ‘About This Ad.’ Currently, this is available for display ads purchased through Google Ads and Display & Video 360, this feature will be brought to all ad surfaces in 2021.

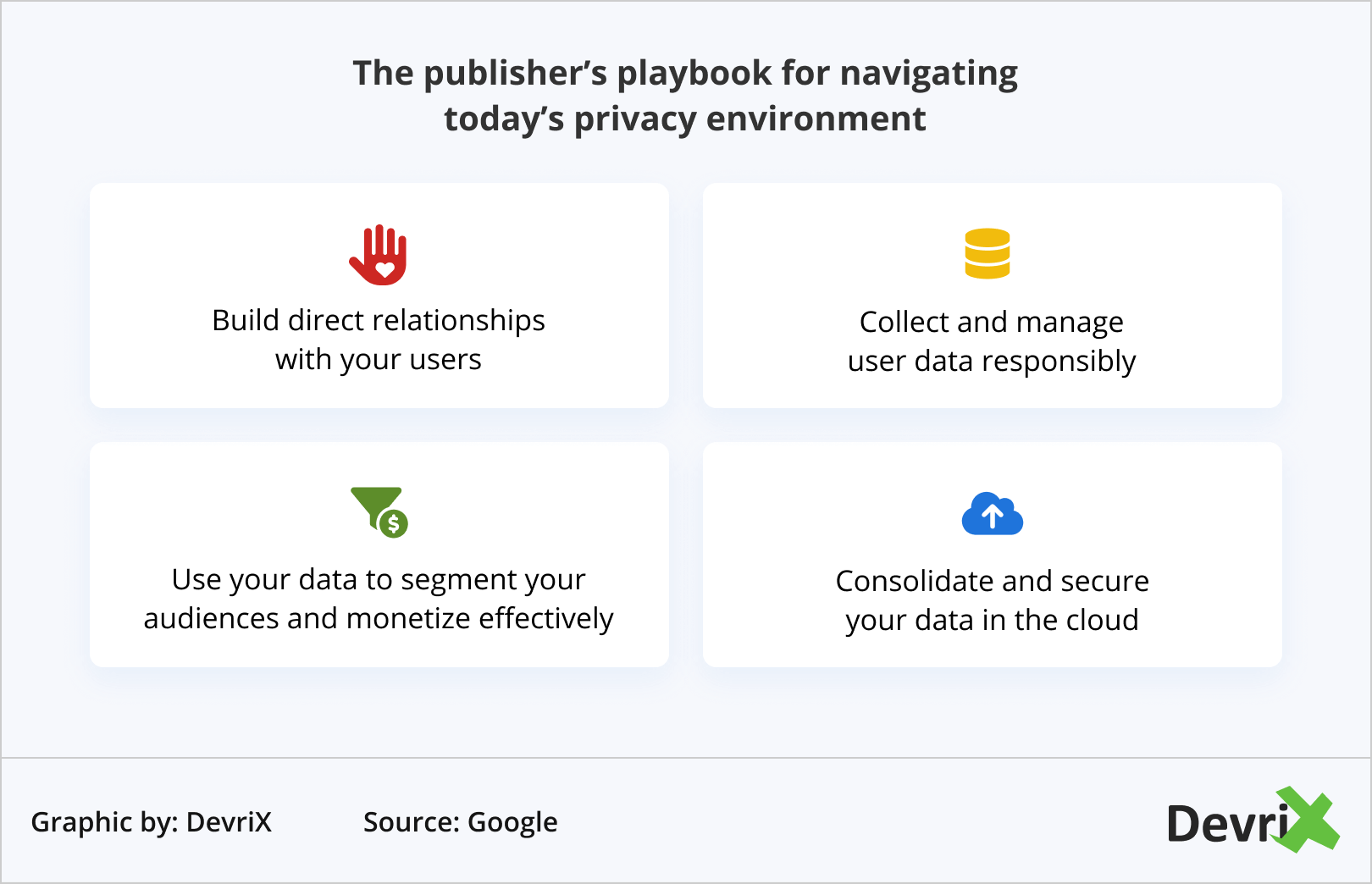

In 2020, Google published a ‘playbook’ for publishers to navigate them through the new digital environment. Here is a list of Google’s recommendations:

And further on privacy-related recommendations:

However, Google’s Privacy Sandbox solutions are coming along with a lot of antitrust issues. Some adtech companies, like Criteo, are very worried that the solutions are too centered around the browser, giving Chrome too much control. There is an antitrust class-action lawsuit filed against Google just two months ago that raises all the publishers’ concerns. Some of the main ones are that the adtech mogul has the information advantage to strategically harm any publisher who refuses to use its intermediaries.

The outcome of this lawsuit is going to affect the way Google makes the change to having a cookieless browser in 2022.

First-party Data Is the Future

First-party data could be sourced from the publisher’s own analytics, DMP or CRM. This, in fact, gives the publisher greater freedom over revenue optimization. Infosum, on the other hand, proposes another solution, such as the partnership between publishers.

Alliances between publishers could help them use a unified addressable audience and can give them scale to create a working alternative to the so-called walled gardens. Basically, the digital ecosystem could be separated into two-walled gardens and everyone else.

The walled gardens are platforms where the user has to log in and identify himself, such as all the big advertising entities like Google, Amazon, Facebook. The first-party data they have is pure gold and it makes them even more powerful in the way they control how digital advertising will be executed.

Just to clarify, removing third-party cookies, won’t mean removing targeting. As mentioned in Cookiebot, apart from cookies, there are other ways to track users such as local storage, indexedDB, Web SQL, which we won’t consider here.

User IDs and Identity

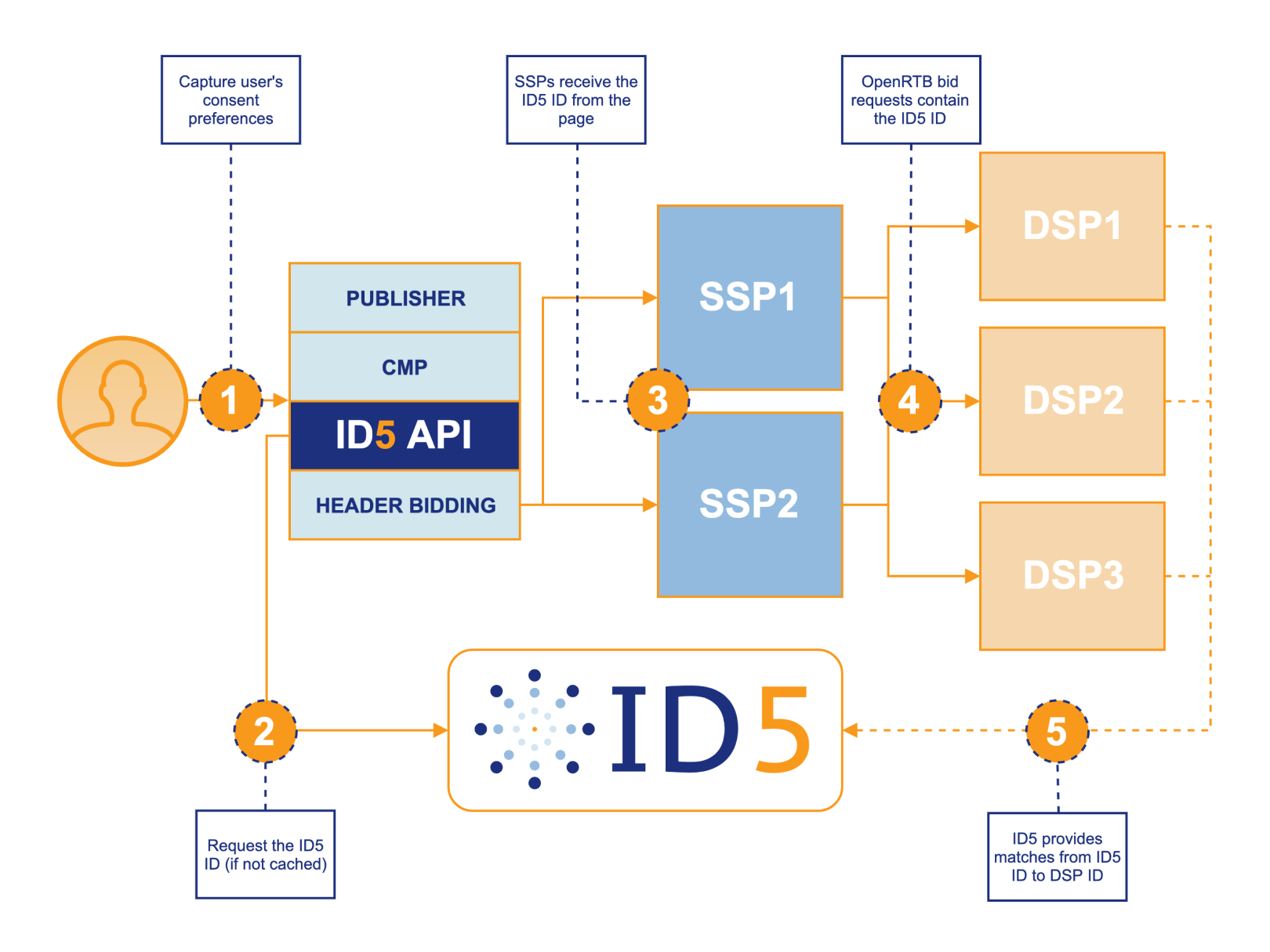

Some viable solutions for the new privacy-based digital advertising ecosystem are Universal IDs or Unified/Shared IDs (different names used by the different vendors). The Unified IDs are standardized cookie-based identifiers synced among all DSPs, DMPs, and SSPs and available for desktop, mobile, and tablet experiences. The IDs are like a first-party data cookie but work in a third-party cookie fashion.

The Unified ID Solution by Trade Desk and in cooperation with Index Exchange was one of the first proposals for IDs. There are already many providers with Universal User IDs solutions such as, but not limited to, The Trade Desk, the Advertising ID Consortium, LiveRamp, and ID5.

For Publishers with Prebid implementations

In particular, if you have a Prebid implementation for header bidding on your site, these are all the universal IDs you can choose from if you have decided to test for changes in performance: ID5, Identity link by LiveRamp, IdX, Intent IQ, Liveintent ID, lotame panorama ID, Merkle, NetID, Parrable ID, Pubcommon ID, Pubprovided, Quantcast, UnifiedID by Trade Desk, Verizon media connectID.

In December of last year, Prebid actually introduced their own solution in collaboration with Pubmatic, called SharedID, aiming to put the publishers on the front line of this fundamental change in the digital advertising industry.

Merging PubMatics’s PubCommon ID with the Prebid’s SharedID could be a game-changer in terms of the quicker adaptation of the ID technology among lots of publishers, as the CTO of the AdFrom argues.

What is interesting about the Prebid solution is that since it’s community-owned, it is also supposed to bring more transparency between the parties involved, across publishers and DSPs. Another important feature is that the publishers can choose whether to use the identifier as either first-party or third-party data value and decide whether they want to share it with the bidders.

Will Universal IDs Increase Revenue for Publishers?

There are many arguments for the introduction of universal IDs which are thought to be a promising game changer. Here are some of the advantages they offer publishers:

- Reduced page load times, which will boost the publisher’s revenue.

Especially, with the widespread adaptation of header bidding, the number of cookies in the bid requests has increased eightfold. That is why, the cookie depletion could be quite beneficial for publishers in terms of page loading speed.

It will also substantially improve the user experience. - Efficiency will increase because of lighter code weight and less bandwidth requirements.

- Universal user IDs could maximize the accuracy of DSP match rates, which could generate higher bids.

- Unlike cookies, IDs work across all devices so there is better attribution.

- Reduced audience loss.

Some providers have shown uplifts in ad revenue due to the introduction of User IDs, and we are really hopeful about that. Pubmatic has a case study about the effect of universal IDs and they found an uplift of 95% in bid opportunities. According to another one, done by Pubstack, identity seems to provide an uplift of at least 5% for Prebid bidding.

However, we have to be open to new scenarios. Last summer IAB Tech Lab, which founded the industry’s “first and only neutral, independent, non-profit, shared ID service” called DigiTrust, actually had to close the service. So the future of shared IDs might not be set in stone, but we are vested in following closely how this will enfold. Hopefully, proprietary solutions like the one by TradeDesk and first-party data IDs will be here to stay.

Another point to keep in mind concerning IDs is that the user’s privacy is not the same as the publisher’s privacy. Although universally adopted IDs can mitigate some losses of publisher’s data, as Paul from AdExchanger argues, in the worst-case scenario there could be data leakage for publishers and they should be really careful. Advertisers will still be able to use publishers’ data, target cohorts and not send any revenue back to the publishers.

3. Privacy-Oriented Future

All big changes provide opportunities. The removal of third-party targeting and cookie-based digital advertising in Chrome is one of the biggest changes in adtech which we will see in the following year.

That’s why we believe the shift to first-party data across all browsers will bring a lot of room for innovation. As Sarah Polli, director at Hearts and Science said:

While it may seem like doom and gloom, the evolution of data privacy presents an opportunity for transformation.

The shift to a cookie-less and privacy-centric world would also lead to deep investment in data management tools. And subscription walls and paid media could become one of the few long-term solutions.

Hopefully, the advertising industry will find solutions that can address the problems of privacy and inefficiency at the same time. Though only time will show if there will be one unified persistent ID. Until then, we hope that all the changes across browsers and ad vendors will lead to a more efficient and better working advertising ecosystem for everyone.

We, at Devrix, believe that new exciting times are coming and we are devoted to making 2021 really count for our clients with novel ad ops solutions. If you are a WP publisher, we would love to help you navigate through the uncertainty and work out any challenges you might experience.