Online shopping has been all the rage for a couple of years now. Most people are drawn to it because of the convenience that it provides, as you don’t even have to go out of your house to buy the things that you want or need. All you need is a mobile device or a computer, an internet connection, some of your favorite shopping apps and websites, you are good to go!

This is the reason why more and more websites and apps are integrating online and mobile checkouts. Aside from the possibility of reaching a lot more people online, you also get the chance to offer fast, convenient, and secure checkouts for your customers.

However, choosing the right mobile payment to integrate into your website or app can be quite confusing. There are tons to choose from and today, we will discuss which ones would be the best for you to use.

PayPal

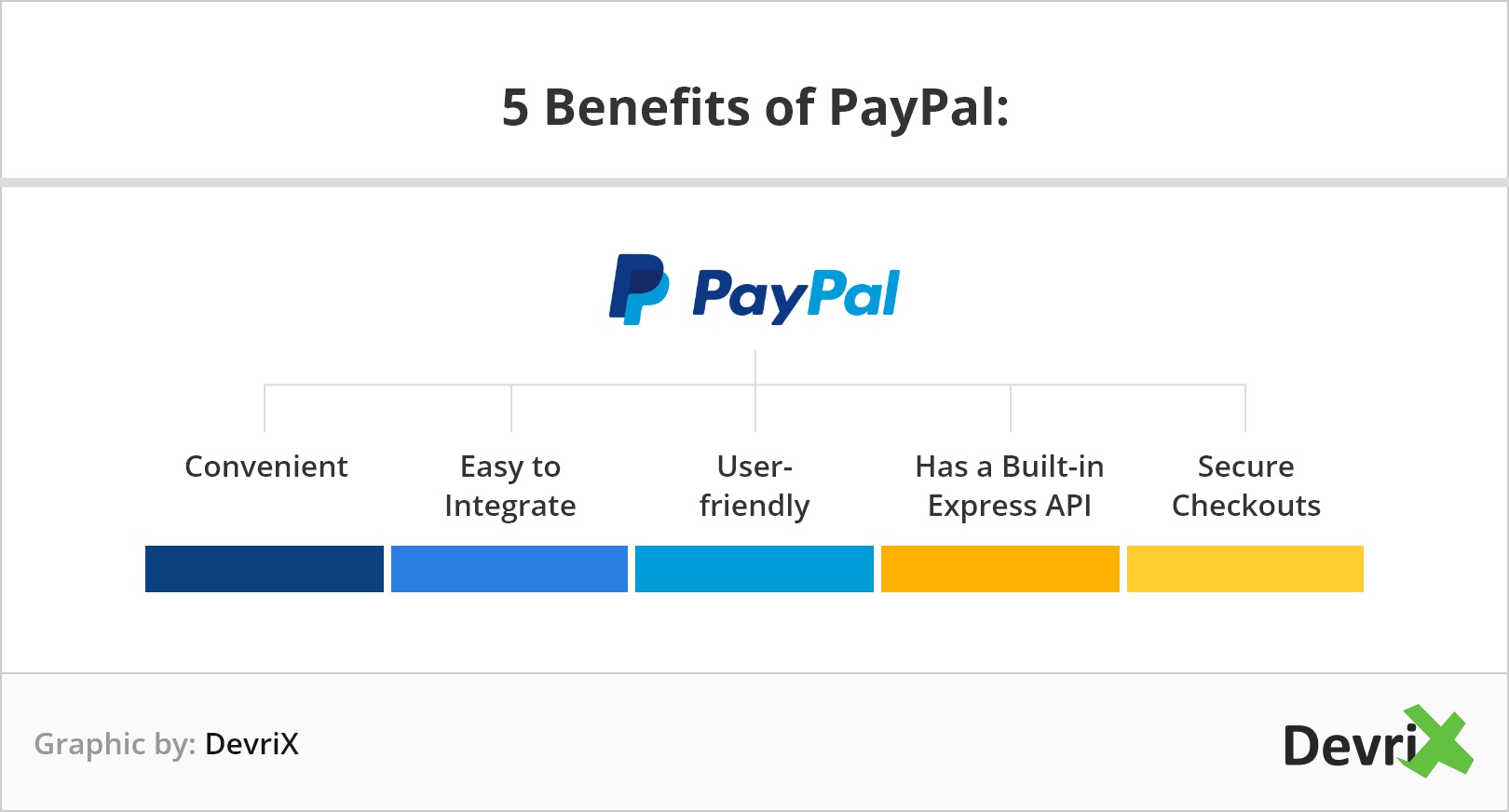

PayPal has been around for over 2 decades now, and it is one of the most well-known and used online payment tools. It is convenient, easy to integrate, and most of all, easy for your customers to use.

The best part about PayPal is that it is a gateway for credit and debit cards. Users can easily link their cards to PayPal and use that as a mode of payment for their online transactions. Additionally, PayPal also has its own “wallet”, which means that users can receive and transfer money from the app without having to use a credit or debit card. This is extremely useful for people who do not have their own cards but are keen on purchasing from online shops.

PayPal is also easy to integrate, as its built-in Express API works well with almost all of the major platforms. However, they usually redirect the buyers to their main website for faster and secure checkouts.

PayPal charges its customers with a couple of bucks for every single transaction. It’s just the standard amount though, which is 2.9% plus $0.30 for local transactions and 3.9% plus a fixed fee for international transactions. PayPal has over 220 million active users around the globe, which means that most of your customers would find it convenient if you have this as one of your payment methods.

Braintree

Braintree may just be about 10 years old, but it is considered as one of the most progressive payment gateways in today’s mobile commerce industry. Just like PayPal and other big apps and payment gateways in the industry, Braintree also accepts traditional payments via debit and credit cards. They even accept bitcoins, which is often a plus since a whole lot of people use bitcoins nowadays for their online purchases.

This payment gateway supports huge platforms such as Magento, Shopify, Bigcommerce, and a whole lot more. Just like with PayPal, their rates are kept at a standard – that’s 2.9% after $50,000.

Again, you definitely would want to protect your customers and make sure that their data is safe and secure. One amazing thing about Braintree is you do not have to sign a contract when working with them, so you own all the rights to your customers’ data. Huge companies such as Dropbox, Uber, and Yelp use Braintree for their checkout payments.

Stripe

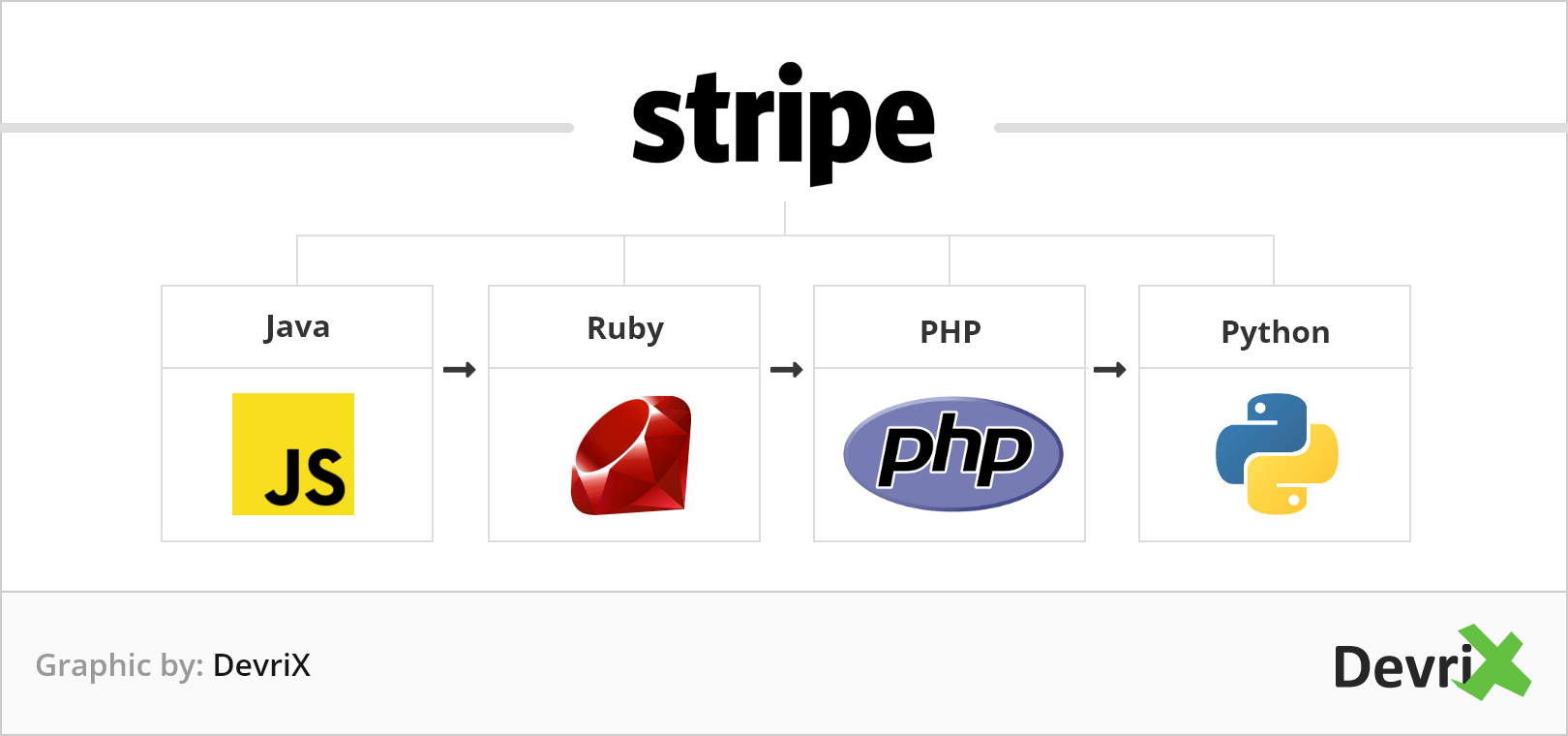

Stripe handles billions of dollars worth of online transactions per year. This tool is not like PayPal or Braintree though, as it gives you the flexibility to customize your payment process the way you want it.

While this might not sound inviting to small businesses, larger firms are usually the ones who take advantage of this. Huge companies can choose from a wide range of APIs that can help you with creating your own marketplaces, subscription services, and even crowdfunding pages. It also offers a plethora of development languages, ie. Java, Ruby, PHP, and Python.

Stripe also boasts the ability to support more than 100 currencies, so if you have a global audience, then this would be amazing for you. This gateway plan might require a little more knowledge from your developers, but it would definitely be worth it once you’ve gotten the hang of it.

For European cards and users, the fee is at 1.4% plus 20p per transaction. For international cards, the processing fee is at 2.9% + $0.30 per charge.

Apple Pay

If you have lots of customers who are Apple users, then they would most likely be glad that you have Apple Pay as one of your payment options. Apple Pay, just like with other Apple products and services, is strictly just for iPhone, Apple, and Safari users. With just a single touch, your users can easily checkout without any hassle.

However, the integration can be quite difficult on your end. Also, Apple Pay is not readily available in a lot of countries, which can be problematic if you have a wide global audience. If your audience is mainly located in the USA though, then Apple Pay might just work for you and your customers.

Payline

What’s amazing about Payline is that it can handle small to large-scale businesses. Just like with the other ones on this list, Payline takes care of your gateway payment processing to make sure that your customers actually check out what’s in their shopping carts.

It’s also easier for developers and companies, as Payline’s web solutions can be integrated with about 175 online shopping carts. It can also be easily integrated with Quickbooks so you can easily get on with your financials and payroll management.

Another plus with Payline is that it offers lower transaction rates compared to its competitors. Their bricks and mortar stores are at $10 per month, with just a 0.2% fee plus $0.10 per transaction. When it comes to online stores, the prices start at $20/month with a transaction fee of just 0.3% and $0.20.

Amazon Payments

Amazon is a huge website and online store, which is why they have decided to integrate their own payment gateway and share it with the rest of the world. Its aim is to make payments safe, secure, simple, and fast for customers to be encouraged to check out what’s in their shopping carts.

Their services are readily available for both customers and merchants. If your customer has their own Amazon account, then they could easily integrate and use that account to make checkouts easier and faster for them. Amazon Pay works well for both website and mobile payments and supports several languages to cater to your global audience.

Amazon Pay charges 2.9% on all domestic transactions plus $0.30 per transaction, while international fees are at 3.9%.

Authorize.Net

Authorize.Net is one of the biggest payment gateways in the industry, with over 400,000 merchants using it as their own payment gateway. It handles major platforms such as X-Cart, Magento, Volusion, and a whole lot more.

It has been around since 1996, so they are considered as one of the pioneers in the business. Authorize.Net has its own Merchant Interface, so you can easily set up several user accounts to control their access.

Authorize.Net charges $99 for their setup fee, plus a $20/month and $0.10 per transaction fee.

Adyen

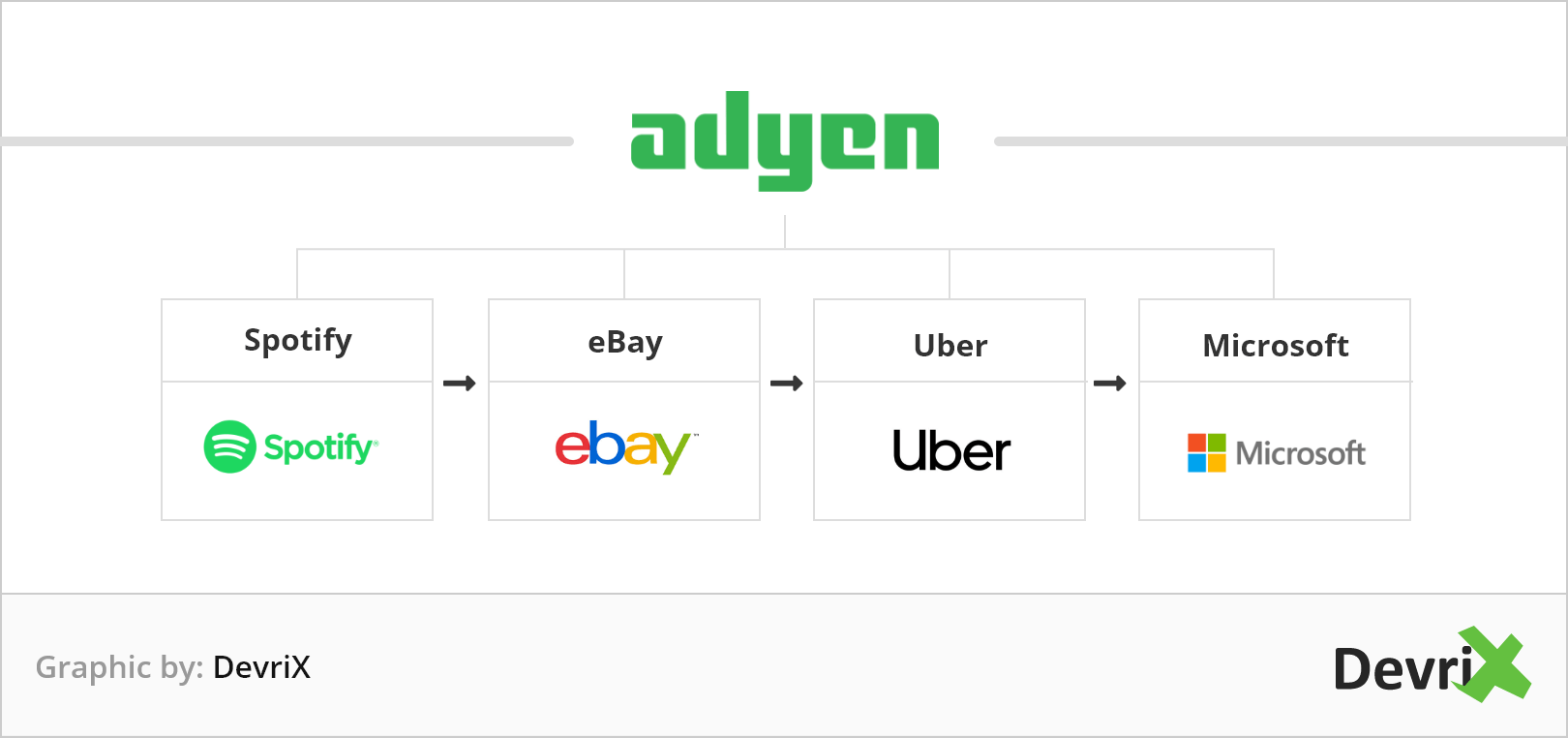

Adyen is associated with some of the biggest companies in the world such as Spotify, eBay, Uber, and Microsoft. It is quite similar to Stripe in the sense that it is an out-of-the-box solution that lets you customize your payment schemes.

With Adyen, you have the freedom to manage the risks and track your results using their advanced tools. They accept over 250 payment methods and 150 currencies from all around the world. Their amazing analytics tools allow you to analyze your customer’s transactions and behavior patterns so you can appropriately tweak your products and services accordingly.

Additionally, it also has a useful management tool that allows you to take a look at the data so you can easily help your customers prevent fraud and scams.

The pricing is a bit complex though, as the processing fee depends on the method of payment. They do add an additional transaction fee of %0.12 for most of their transactions.

World Pay

World Pay is one of the biggest gateway apps in the USA, with over 150,00 merchants in that country alone. They have been around for years and years now, which is why they have one of the biggest customer bases in the industry.

However, World Pay is not the best when it comes to customer service. They also require contracts for as long as 3 years, so if you want to keep your customers’ data private, then you might want to try and get another payment gateway that has no contract. They might offer smaller fees than most of its competitors, but it might not be worth taking that risk if you want to keep your data safe and secure.

Android Pay

There are billions of Android users all around the globe, which means that your customers who are also Android users will most likely rejoice if they see that you have Android Pay as one of your payment options.

Android Pay boasts hassle-free checkouts, a very secure fingerprint scanning, and a convenient tap-to-pay system. Google Wallet allows its customers to link their credit and debit cards into their Android Pay accounts so customers can use it without the hassle of complex sign-ups and log-ins.

Conclusion

It is best to talk to your developers and discuss which payment gateway options would be best to integrate into your m-commerce system. Consider your priorities and see what your customers need so you can encourage them to buy what’s in their cart. Remember: the easier it is to pay and checkout, the higher the possibility of them actually buying the products or services.

It’s all up to you if you want to go for simplicity, versatility, or familiarity when it comes to payment gateways. Do your research and read on a potential payment gateway before actually implementing it into your website so you would not have problems with it in the future.